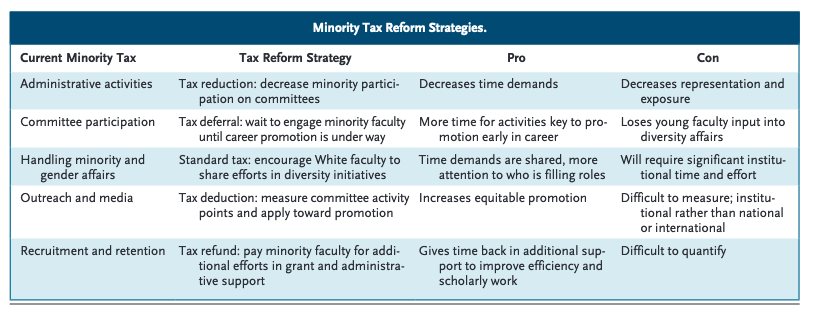

minority tax pros cost

With changes to mortgage tax relief over the past few years that number has grown substantially. Think about that for a moment.

/renting-vs-owning-home-pros-and-cons.asp-ADD-V2-2ce9de919eb94f62bd4e4c7a23010852.jpg)

Renting Vs Buying A Home What S The Difference

The cost for non-union workers was just 3546 per hour.

. If youre tired of cramming everything into a small urban apartment youll love loft living. Income tax rates vary a lot from state to state. His reign of 72 years and 110 days is the longest recorded of any monarch of a sovereign country in history.

Calling capital punishment in the US. Because the states sales tax rate is high too. The media business is in tumult.

Some of the reasons for the high cost of the death penalty are the longer trials and appeals required when a persons life is on the line the need for more lawyers and experts on both sides of the case and the relative rarity of executions. With the additional amount local municipalities can add on. Renting a Home vs.

Then 5 in income taxes. The top income tax bracket of 945 percent is the fifth highest combined state and local income tax rates in the country behind New York Citys 1135 percent Californias 103 percent Rhode Islands 99 percent and Vermonts 95 percent. Think about a state like Oregon.

According to Statista it cost businesses an average of 5073 per hour in wages and benefits to pay union workers in 2021. From the production side to the distribution side new technologies are upending the industry. The 40000 option cost the 24000 geological and geophysical expenditures if paid or incurred prior to the enactment of the Energy Tax Incentives Act of 2005 and the 25000 bonus should be capitalized as leasehold costs of the 2500 acres of land selected.

When living in a state that has an average income tax. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Broken 56 elected prosecutors.

Additional Medicare Tax withholding applies only to wages paid to an employee that are in excess of 200000 in a calendar year. Before signing a lease on a spacious new loft apartment make sure you understand the pros and cons of lofts. The state tax rate is right up there with high tax East Coast states such as New York and New Jersey.

Combine the states base sales tax rate. Buts its common to pay about 5 of your income. The payroll tax rate totals 124 percent of earnings up to the taxable maximum the rate is 62 percent from workers and 62 percent from employers and 124.

Our experienced journalists want to glorify God in what we do. Marylands state sales tax is six percent. It offers loans to minority buyers without the need for a down payment closing costs or private mortgage insurance PMI an extra cost thats customary for buyers who put down less than 20 of the homes purchase price.

Louis XIV Louis Dieudonné. The bill would reinstate a long-lapsed Superfund-related tax on crude oil and imported petroleum products at the rate of 164 centsper barrel which would be indexed to inflation. Solar Power Pros and Cons.

Withholding rules for this tax are different than the income tax withholding rules for supplemental wages in excess of 1000000 as explained in Publication 15 section 7. A couple in the minority. It ranks as one of the top 10 highest among all of the states in the country.

Buying a home is a huge part of the American DreamChoosing to buy or rent though is a major decision that affects your financial health. It used to be the case that only a tiny minority of property investors would buy a house through a limited company. Unions tend to drive up the cost of labor for businesses in their area.

Praise for An Inconvenient Minority Asian American success shows that hard work self-discipline and strong families still pay large dividends in the US. So if you make a lot of money. And you will see rates pushing 7 on your purchases.

Postal applications take between eight and 10 days and cost 40. Watch the NFLs Sunday Night Football NASCAR the NHL Premier League and much more. Yet Asians now find themselves subject to quotas that limit their access to jobs and admission to selective schools in part because high levels of Asian achievement undercut the progressive narrative that white.

Lets say you make 50000 a year. Affiliate marketing is a type of performance-based marketing in which a business rewards one or more affiliates for each visitor or customer brought by the affiliates own marketing efforts. Set us as your home page and never miss the news that matters to you.

Theyre Usually Spacious with an Open Concept and High Ceilings. Or closer by New Hampshire. The total cost of the Social Security program for the year 2019 was 1059 trillion or about 5 percent of US.

Unions can also increase the cost of non-union labor by pushing for higher minimum wages. Affiliate marketing may overlap with other Internet marketing methods including organic search engine optimization SEO paid search engine marketing PPC Pay Per Click e-mail. This too is a lot of tax.

High taxes are no way to streamline your finances. Certified cost or pricing data means cost or pricing data that were required to be submitted in accordance with FAR 15403-4 and 15403-5 and have been certified or is required to be certified in accordance with 15406-2. EV range continues to improve.

On a full charge most electric models are limited to a range of 60 to 100 miles but a small minority of models can go between 200 and 300 miles per charge. Were serious about helping our readers consumers and businesses. Furthermore the highest marginal tax rate of nearly 9 is not good.

Although Louis XIVs France was emblematic of the age of. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Mediagazer presents the days must-read media news on a single page.

Youll get tax credits. Iowa may not. This certification states that to the best of the persons knowledge and belief the cost or pricing data is accurate.

5 September 1638 1 September 1715 also known as Louis the Great Louis le Grand or the Sun King le Roi Soleil was King of France from 14 May 1643 until his death in 1715. The best opinions comments and analysis from The Telegraph. Pros and Cons of Renting a Loft.

And some income taxation of Social Security benefits. Should you need it a same-day service costs 100 you.

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

National Minority Health Month Raising Awareness And Encouraging Action To Address Health Disparities Network For Public Health Law

Financial Resources For Hispanics Latinos Moneygeek Com

2020 Tax Software Survey Journal Of Accountancy

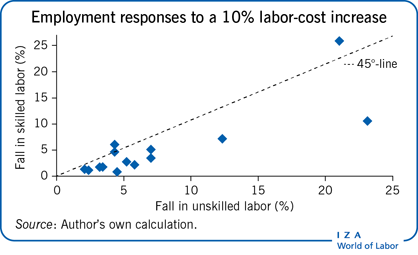

Iza World Of Labor Do Labor Costs Affect Companies Demand For Labor

2020 Tax Software Survey Journal Of Accountancy

Tax Breaks For Minority Owned Businesses

Whitewashed America S Invisible Middle Eastern Minority Critical America 46 Tehranian John 9780814782736 Amazon Com Books

Marina Di Bartolo Md Dibartoloim Twitter

How Government Learned To Waste Your Time The Atlantic

Tax Preparer Certification Accounting Com

Personal Income Pi In The Us Tax Foundation Data

How The U S Tax System Disadvantages Racial Minorities The Washington Post

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

2020 Tax Software Survey Journal Of Accountancy

29 Crucial Pros Cons Of Taxes E C

/dotdash_Final_How_To_Calculate_Minority_Interest_Oct_2020-01-54830679f6a34b8581810db05d008661.jpg)

How To Calculate Minority Interest

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep